The High Cost of Weak Pipelines: Fixing Lead Quality Before It’s Too Late

Just like a cracked pipe leaking water, weak pipelines drain time, money, and credibility.

Why poor lead quality silently drains revenue, stalls growth, and erodes trust — and how to fix it before forecasts collapse.

A sales team hits its pipeline target and celebrates. The numbers look strong, leaders feel confident, and the quarter seems secure. But when closing time comes, the pipeline collapses. Deals stall, forecasts fail, and everyone is left asking what went wrong.

The painful truth is that poor lead quality drains time, money, and credibility. A pipeline packed with weak opportunities does not drive growth, it destroys trust.

This post will show why weak pipelines are so dangerous, what healthy pipelines really look like, and how to strengthen lead quality before it is too late.

The Hidden Cost of Weak Pipelines

The damage caused by poor lead quality runs deeper than most leaders realise:

Wasted resources and budgets

MarketJoy found that companies lose as much as $20,000 per sales rep, per year chasing low-quality leads that will never convert [1].

Did you know? Objective Management Group reports that 27% of opportunities in the average pipeline are not really qualified — yet they still appear in forecasts [2]. That is phantom revenue that inflates expectations and makes leaders overconfident.

Data decay and inaccuracy

According to AtData, around 30% of CRM information becomes inaccurate every year due to job changes, outdated contacts, and incomplete data [3].

Morale and retention issues

Demand Gen Report found that 60% of B2B organisations struggle with poor data quality, which slows productivity across sales and marketing and directly contributes to burnout [4].

The Root Causes of Poor Lead Quality

Pipeline weakness is usually a process issue, not a rep issue. Common structural causes include:

A fixation on lead volume rather than fit.

Misalignment between marketing and sales on what “sales-ready” really means.

Weak or inconsistent qualification frameworks.

Poor visibility into stalled or duplicate opportunities.

The result is activity without progress — a busy funnel that hides fragility.

What a Healthy Pipeline Really Looks Like

Strong pipelines are built on integrity and clarity:

Ideal Customer Profile fit

Only pursue opportunities that clearly match your Ideal Customer Profile (ICP) — the type of customer most likely to buy and succeed with your solution.

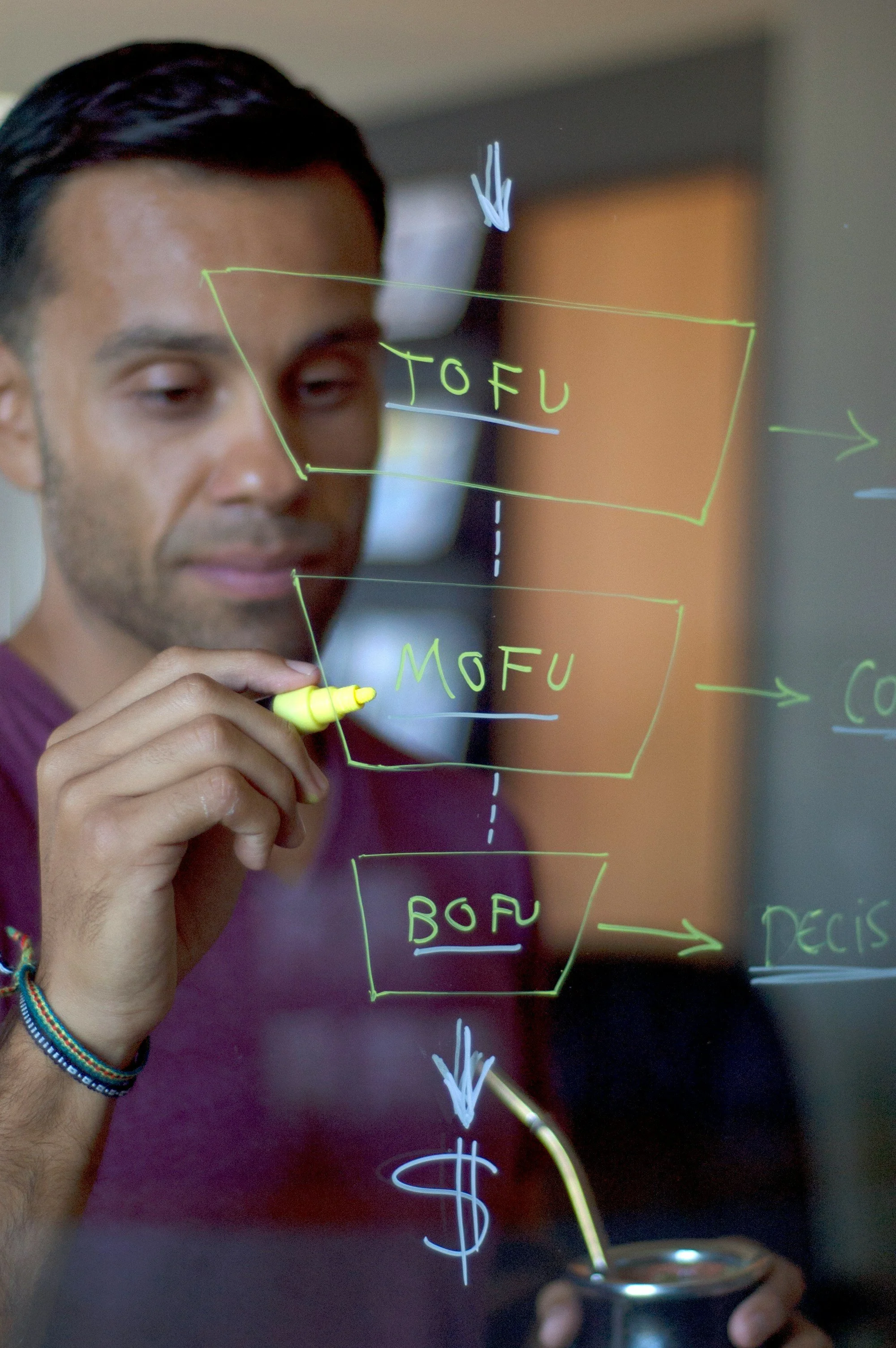

Early qualification

Frameworks like Fresh Perspectives’ 4x5, BANT, or MEDDIC applied consistently at the first call help ensure only real opportunities enter the pipeline.

Clear stage definitions

Salesforce data shows that companies with documented stage exit criteria achieve 28% higher conversion rates than those without [5].

Balanced distribution

A healthy pipeline avoids a pile-up of early-stage deals that will never close.

Tracking meaningful metrics

Companies that measure the growth rate of qualified leads month to month (known as Lead Velocity Rate or LVR), the conversion of marketing-generated leads into sales-ready opportunities, win rate, and time to close create far more predictable revenue [6].

How to Fix Lead Quality Before It’s Too Late

Turning lead quality around requires structured action:

Tighten qualification frameworks

Harvard Business Review found that sales reps who consistently apply qualification criteria are 33% more likely to hit quota [7].

Align marketing and sales

SiriusDecisions research shows that organisations with shared definitions of a “qualified lead” grow revenue 19% faster than those without alignment [8].Use predictive data scoring

A 2023 study in the Journal of Marketing Analytics confirmed that predictive scoring based on behavioural and intent data is significantly more accurate than manual scoring [9].Audit pipelines regularly

McKinsey reports that companies running quarterly pipeline clean-ups see 15% higher forecast accuracy [10].Invest in data hygiene

Forrester found that organisations actively managing data quality achieve 35–40% higher campaign ROI than those that do not [11].

The Payoff of a Stronger Pipeline

When pipeline health improves, the results follow:

Forecasting becomes more accurate.

Win rates rise and deal cycles shorten.

Leadership and investors regain confidence.

Salespeople stay focused and motivated.

CSO Insights found that companies prioritising lead quality over lead volume achieved 13% higher revenue growthcompared to peers [12].

Closing Thoughts

Pipeline health is not about how many deals you can stack into a forecast. It is about how many of those deals have a real chance of closing. Every weak lead left in the system wastes time, drains credibility, and slows growth.

So ask yourself: if your pipeline was stress tested today, how much of it would still stand strong? If the answer makes you hesitate, start with one pipeline review this quarter. Remove phantom revenue, tighten qualification, and measure how much healthier your forecast becomes.

Want to stress-test your pipeline? Contact us for a health check and see how much phantom revenue you can remove.

References

MarketJoy (2024). The Hidden Cost of Low-Quality Leads and How to Avoid Them.

Objective Management Group (2023). How to Use Data to Analyse Your Sales Pipeline.

AtData (2024). The Hidden Costs of Poor-Quality Leads and How to Avoid Them.

Demand Gen Report (2023). Lead Data Quality as a Critical Barrier to B2B Growth.

Salesforce (2023). State of Sales Report.

Leads at Scale (2024). How to Analyse Pipeline Health for Bottlenecks.

Harvard Business Review (2022). Why Qualification Discipline Predicts Quota Attainment.

SiriusDecisions (2023). Marketing and Sales Alignment Study.

Journal of Marketing Analytics (2023). Comparative Accuracy of Predictive vs Manual Lead Scoring.

McKinsey & Company (2023). Improving Sales Forecast Accuracy through Pipeline Hygiene.

Forrester (2023). Data Quality and Marketing ROI Benchmark Report.

CSO Insights (2023). Sales Performance Research Study.